Navigating the Rural Landscape: A Comprehensive Guide to USDA Mortgage Eligibility

Related Articles: Navigating the Rural Landscape: A Comprehensive Guide to USDA Mortgage Eligibility

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Rural Landscape: A Comprehensive Guide to USDA Mortgage Eligibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Rural Landscape: A Comprehensive Guide to USDA Mortgage Eligibility

The United States Department of Agriculture (USDA) offers a unique mortgage program designed to expand homeownership opportunities in rural areas. This program, often referred to as the USDA Rural Development Loan Program, aims to revitalize rural communities by making homeownership more accessible to eligible borrowers. While the program’s name might suggest a strict focus on rural areas, the USDA’s definition of "rural" is surprisingly broad, encompassing a wide range of locations across the country.

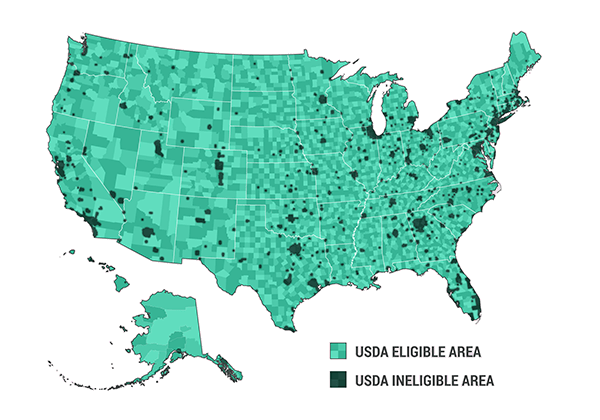

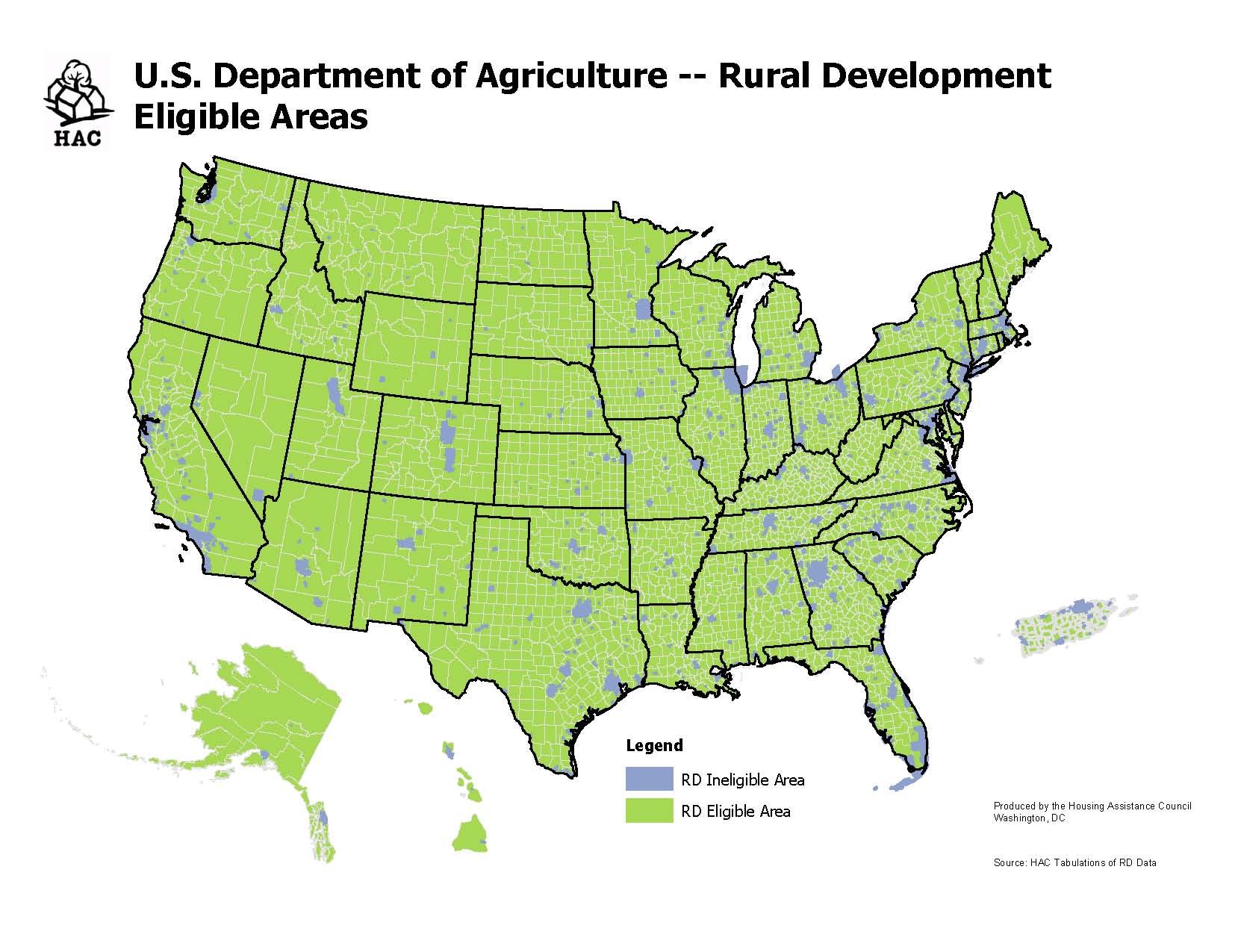

Understanding the USDA Mortgage Eligibility Map

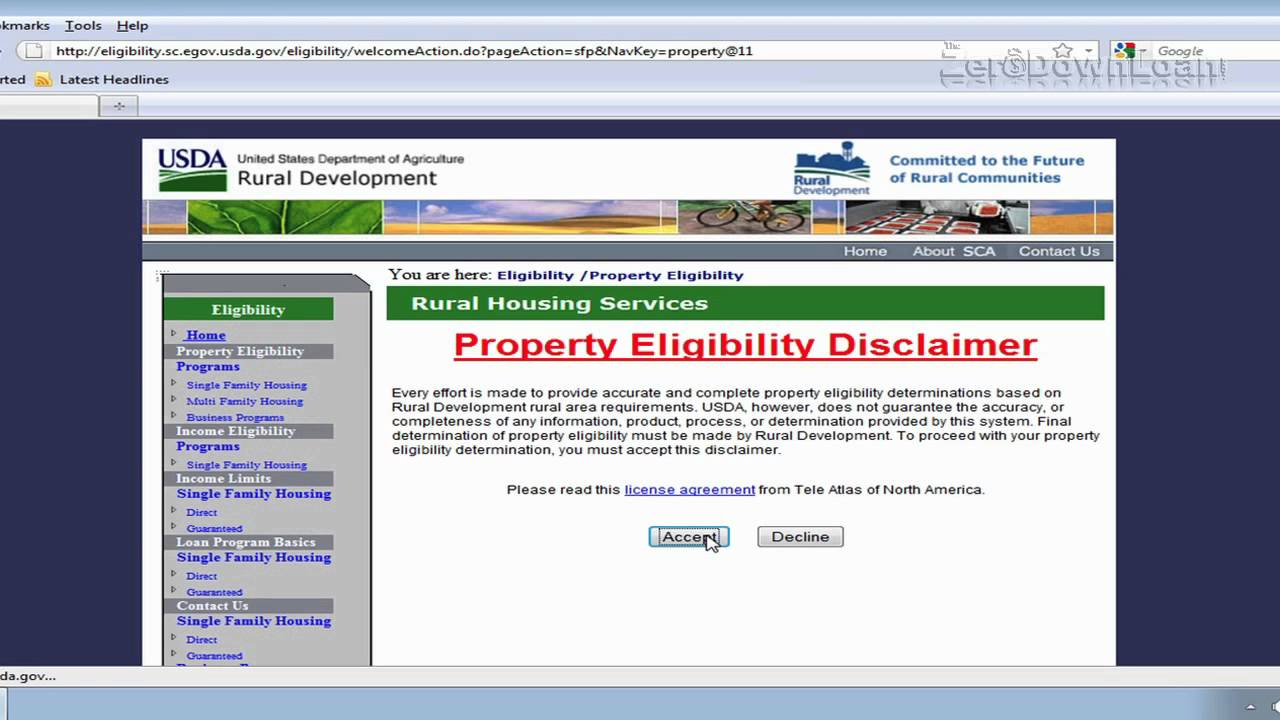

The USDA’s eligibility map is the cornerstone of the program, serving as a visual representation of areas where the USDA loan program is available. This map, accessible online through the USDA Rural Development website, is a valuable tool for potential homebuyers seeking to understand whether their desired location qualifies for the program.

Defining "Rural" in the USDA Context

The USDA’s definition of "rural" extends beyond the traditional image of isolated farmlands. The agency considers a location eligible for the USDA loan program if it meets one of the following criteria:

- Population Density: The area must have a population density of less than one person per acre.

- Population Size: The area must be located in a town with a population of less than 20,000.

- Urbanized Area Boundaries: The area must be located outside of the boundaries of a metropolitan area.

This definition allows the USDA to reach a diverse range of communities, including small towns, suburban areas on the outskirts of cities, and even some rural areas within urban counties.

Navigating the USDA Eligibility Map

The USDA eligibility map is designed to be user-friendly, offering a clear visual representation of eligible areas. The map is typically color-coded, with eligible areas highlighted in green and ineligible areas in gray. Users can zoom in and out to view specific areas of interest, and many online tools allow users to search by address or zip code to determine eligibility.

Benefits of the USDA Mortgage Program

The USDA mortgage program offers several advantages for eligible borrowers:

- Low Down Payment: The USDA requires a minimum down payment of 0%, making it an attractive option for first-time homebuyers or those with limited savings.

- No Mortgage Insurance: Unlike conventional loans, USDA loans do not require mortgage insurance, which can significantly reduce monthly costs.

- Competitive Interest Rates: The USDA offers competitive interest rates, often comparable to conventional loans.

- Flexible Eligibility Requirements: The USDA program has flexible eligibility requirements, making it accessible to a broader range of borrowers.

Who is Eligible for a USDA Mortgage?

While the USDA program is designed to help people in rural areas, it’s important to note that eligibility goes beyond just location. To be eligible for a USDA loan, borrowers must meet the following criteria:

- U.S. Citizenship or Permanent Residency: Borrowers must be U.S. citizens or permanent residents.

- Creditworthiness: Borrowers must have a good credit score and a history of responsible debt management.

- Income Limits: Borrowers’ income must fall within the USDA’s income limits for the area in which they wish to purchase a home.

- Property Requirements: The property must be located in an eligible area and meet the USDA’s property standards, including being a single-family dwelling, a manufactured home, or a multi-family dwelling with no more than four units.

Understanding Income Limits

The USDA’s income limits are based on the size of the household and the location of the property. These limits vary by county and are updated annually. The income limits are designed to ensure that the program benefits those who need it most, particularly low- and moderate-income families.

The Role of the USDA Eligibility Map

The USDA eligibility map is crucial for understanding the program’s reach and determining if a specific location qualifies for a USDA loan. Before embarking on a home search, potential borrowers should consult the map to identify eligible areas. This step helps streamline the process and prevents wasted time and effort on properties that are not eligible for the program.

FAQs about the USDA Mortgage Program

Q: What is the maximum loan amount for a USDA mortgage?

A: There is no set maximum loan amount for USDA loans. The maximum loan amount is determined by the property’s appraised value and the borrower’s ability to repay the loan.

Q: Can I use a USDA loan to purchase a property for investment purposes?

A: No, USDA loans are only available for primary residences. The property must be the borrower’s primary residence and intended for their own use.

Q: Can I use a USDA loan to refinance my existing mortgage?

A: Yes, the USDA offers a refinance program for existing USDA loans. However, it’s important to note that refinancing may not always be beneficial, and borrowers should carefully evaluate the costs and benefits before proceeding.

Q: What are the closing costs associated with a USDA loan?

A: Closing costs for USDA loans are typically lower than conventional loans, but they can vary depending on the lender and the specific loan terms.

Q: What are the requirements for a USDA loan if I am self-employed?

A: Self-employed borrowers must provide documentation of their income, including tax returns, bank statements, and business records. The USDA will review these documents to verify income and assess creditworthiness.

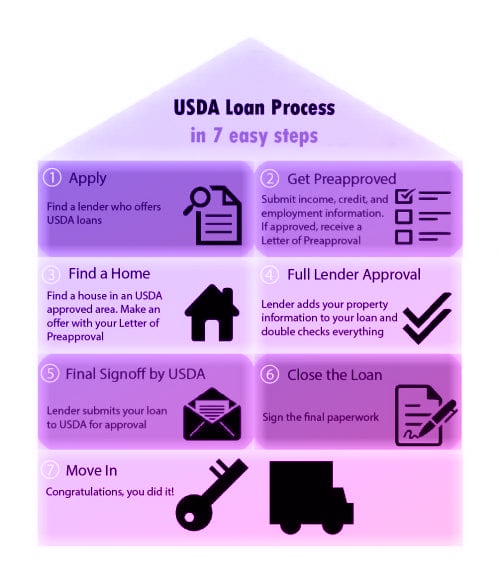

Tips for Utilizing the USDA Mortgage Program

- Consult with a USDA-Approved Lender: Working with a lender experienced in USDA loans can provide valuable guidance and ensure a smooth application process.

- Explore Eligible Areas: Utilize the USDA eligibility map to identify eligible areas that meet your housing needs and preferences.

- Check Your Credit Score: A good credit score is essential for qualifying for a USDA loan. Review your credit report and address any negative items.

- Gather Documentation: Be prepared to provide all necessary documentation, including proof of income, employment history, and credit history.

- Understand the Closing Costs: Familiarize yourself with the closing costs associated with a USDA loan and factor them into your budget.

Conclusion

The USDA mortgage program offers a valuable pathway to homeownership for individuals and families seeking to establish roots in rural areas. By understanding the program’s eligibility criteria, utilizing the USDA eligibility map, and working with a knowledgeable lender, potential borrowers can navigate the process effectively and realize the dream of homeownership. The USDA’s commitment to revitalizing rural communities through accessible homeownership opportunities continues to make a significant impact on the lives of countless individuals and families across the nation.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Rural Landscape: A Comprehensive Guide to USDA Mortgage Eligibility. We appreciate your attention to our article. See you in our next article!